Prominent within all home (and landlords & business package) insurances is a general condition or general exclusion known as the ‘Unoccupancy Clause’.

In simple terms, the policy will not respond, or cover would be reduced or restricted, if the premises is unoccupied for more than a set amount of days – commonly 60days.

Various insurer definitions read as:

- Cover is suspended if your home is unoccupied for more than 60 consecutive days, unless you notify us in writing prior to, and we agree to it.

- Unless We otherwise agree in writing, We will not pay for any loss or damage to Your Business Property if the occurrence happens after Your Business Premises has been unoccupied for more than 60 consecutive days.

- If you leave your home for a period of more than 60 days, you must tell us and have our written agreement. If you do not do so, cover will be limited, restricted or not applicable.

The important takeaway from the Home Insurance Unoccupancy clause relates to the time period, and the requirement to advise.

If you advise ourselves as the broker, and we therefore advise the insurer – it is more often than not agreed to and cover remains in full. If the period is not much greater than 60 days, it would be agreed. If you were having family/friends check on your house, it would be agreed to. If you expected to be away for 6 months, this would present a problem.

The good news of late is the ever increasing time period. Many years ago, the time period was as little as 30 days. More recently, this has extended to a common 60 days.

Now, with the ever improving wordings, our Steadfast Group additional wordings, and through the use of a broker, 90 days is common on many broker policies.

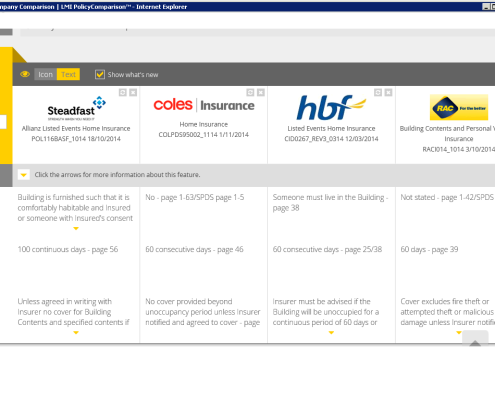

Our main Home/Contents Insurers v Direct Insurers :

Broker Policy’s

- Steadfast Policy’s – now 100days

- Vero Brokered – 90days

- Allianz Brokered – 90days

- QBE Brokered – 90days

Direct Insurers

- RAC direct – 60days

- HBF – 60days

- Coles – 60days

So….If you are going on an extended holiday or have plans to vary your stay at your premises, please give thought to your home insurance unoccupancy clause before doing so. Please consult ourselves, let us know, and we will have it approved! Don’t get home from that perfect holiday and find your house damaged, and not have any cover applicable.